Blog Posts

Spring Market Update: Are the Bulls Still Running in CRE?

Despite the recent roller coaster ride on Wall Street, the latest round of Commercial Real Estate industry surveys points to continued optimism ahead for commercial real estate over the next 12 months.

Read MoreOpportunity Zone Guidance: Round 2

Qualified Opportunity Zone guidance from Treasury and the IRS are a positive step in answering questions that will help to get capital off the sidelines.

Read MoreLIBOR Transition Moves Forward

As LIBOR deadlines come into focus, crafting fallback language and vetting SOFR become top priorities for businesses and regulators. Businesses across the globe are preparing to say goodbye to LIBOR with a move to a new benchmark that has been called a “seismic shift” for many financial institutions.

Read MoreCAM Reconciliation Deadlines Loom Large

A sinking feeling hits many people this time of year as tax time creeps closer. But for landlords in retail real estate, it can be a bit of a double-whammy: Not only are their taxes due, but the deadline for CAM reconciliations looms large as well. Generally speaking, retail tenants’ reconciliations for common area maintenance…

Read MoreReal Estate Outsourcing: Gaining an Edge

Many businesses that once sporadically relied on independent contractors see the wisdom of outsourcing whole functions to firms with specialized knowledge and capabilities.

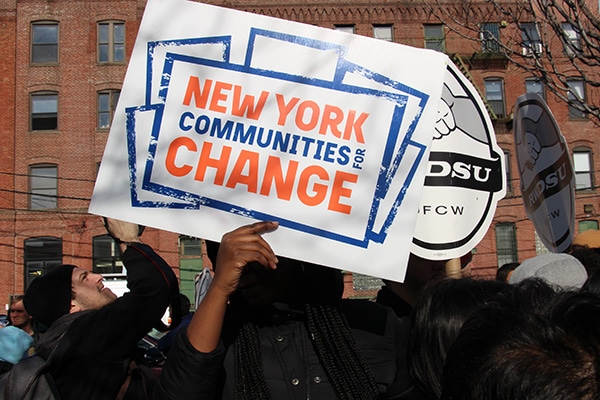

Read MoreOpportunity Zones Development: HQ2 as a Cautionary Tale

Amazon’s announcement that it plans to pull the plug on HQ2 in New York is a cautionary tale for Opportunity Zone investors. Amazon justified its about-face by citing fierce opposition from what The New York Times described as “a group of activists and elected officials who objected to a suite of corporate sweeteners and tax breaks.”…

Read MoreTech Office Tenants: New Powerhouse or Risky Revenue?

Should office investors be wary of tech office tenants adding sector risk to their rent rolls? The tech industry has become a powerful engine driving demand for office space in markets across the country from Silicon Valley to the emerging “Silicon Slopes” of Utah. Do tech office tenants have plenty of gas in the tank…

Read MoreQualified Opportunity Funds: The Real Estate Industry Weighs In

While the government shutdown is holding up the public hearing, we feel it may be instructive to continue to dig into the comment letters submitted on the proposed Qualified Opportunity Zone legislation. One early takeaway was that several real estate industry groups submitted letters, and we wanted to summarize the comments made by those groups…

Read MoreDensification: Retail Investors Double Down on Density

Retail is by no means out of the woods in its battle with Amazon and other online retailers. 2019 kicked off with more Sears stores closings in the wake of its Chapter 11 bankruptcy filing. Despite a last ditch buyout attempt, the retailer had already started shuttering its remaining 142 Sears and Kmart stores last…

Read MoreLIBOR Replacements in Real Estate: Introducing SOFR

U.S. banks lay the groundwork for the successor to LIBOR, replacements emerge for the real estate industry. Since the mid-1980s, the London Interbank Offered Rate, better known as LIBOR, has been the reference on which most floating-rate loans—an estimated $300 trillion in financial contracts globally—are based. However, the financial world was eventually forced to confront…

Read More